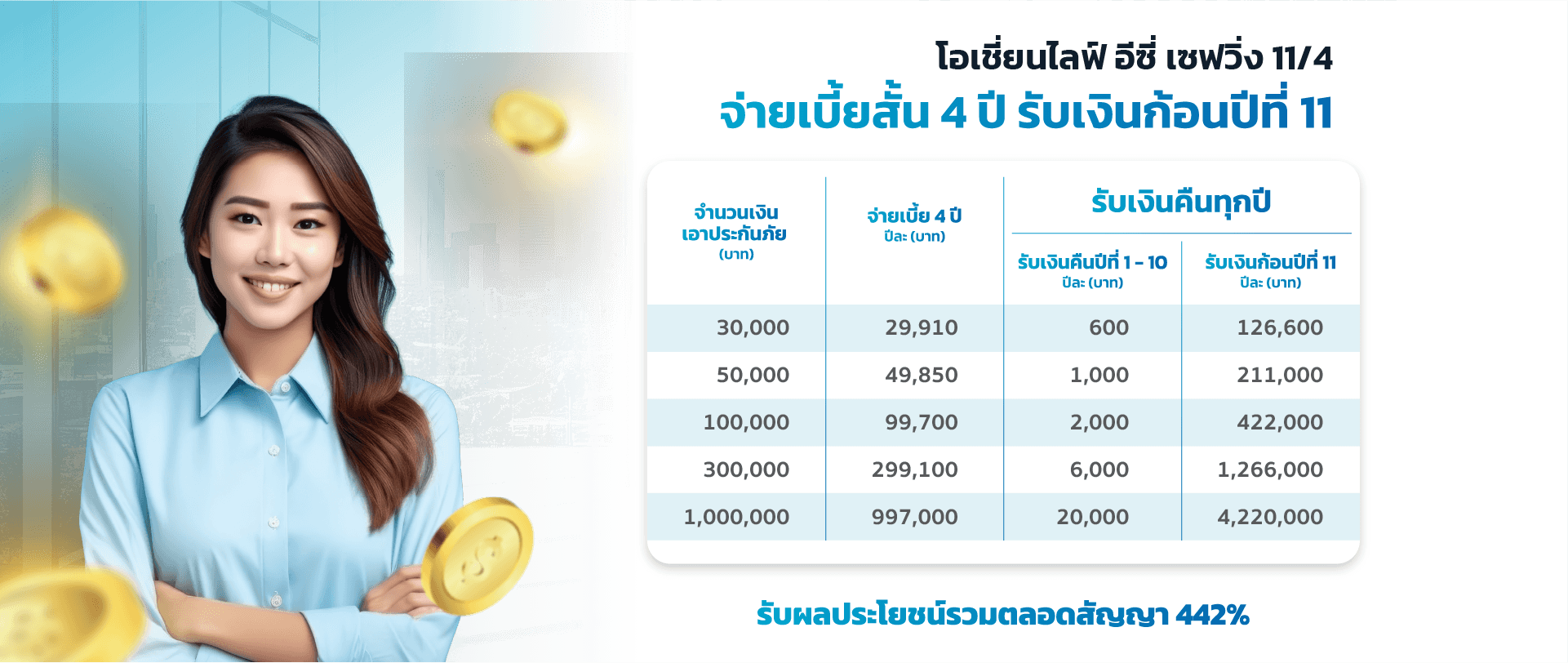

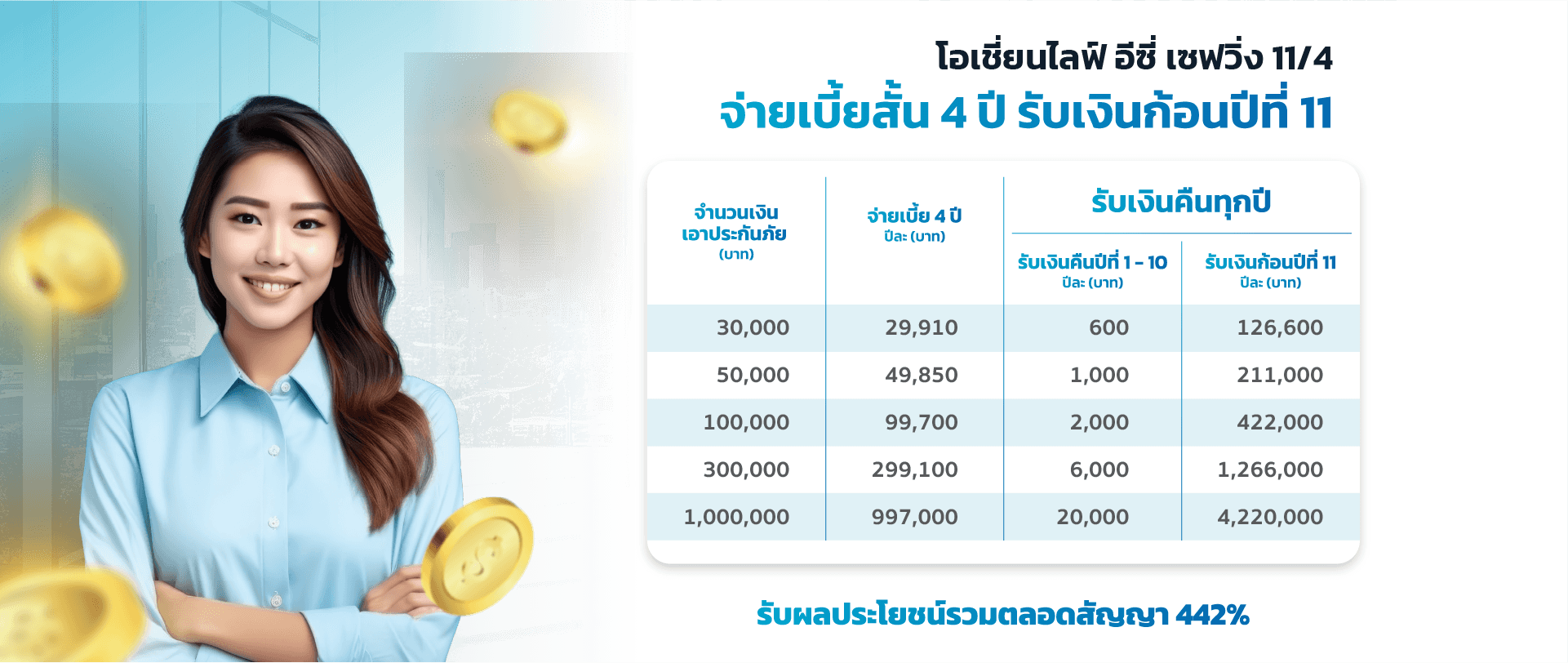

OCEAN LIFE Easy Saving 11/4

ประกันสะสมทรัพย์ ลดหย่อนภาษี

ตัวเลือกของคนชอบความคุ้มค่า!

ประกันสะสมทรัพย์

ลดหย่อนภาษี

ตัวเลือกของคนชอบความคุ้มค่า!

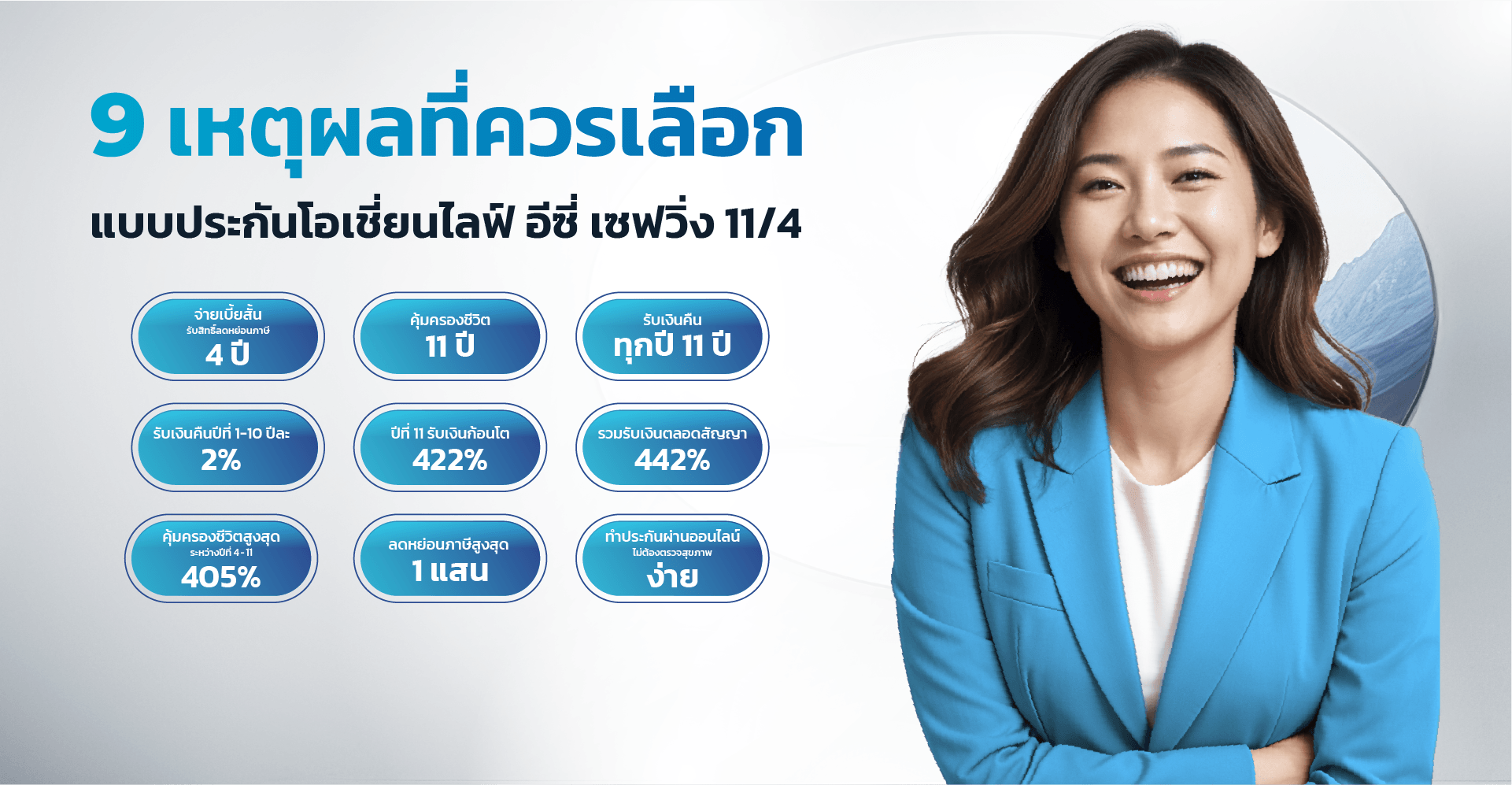

แบบประกันโอเชี่ยนไลฟ์ อีซี่ เซฟวิ่ง 11/4

รับความคุ้มค่าเกินคาด ด้วยผลตอบแทนที่แน่นอน

ผลประโยชน์รวมตลอดสัญญาสูงสุดถึง 442%

สมัครง่าย ผ่านช่องทางออนไลน์

ทำเองได้ทุกขั้นตอน

จุดเด่นแบบประกันโอเชี่ยนไลฟ์ อีซี่ เซฟวิ่ง 11/4

จ่ายเบี้ยสั้น คุ้มครองยาว

จ่ายเบี้ยสั้นเพียง 4 ปี

รับความคุ้มครองชีวิตยาว 11 ปี

รับเงินคืนทุกปี

เงินคืนทุกปี 2%

ระหว่างปีกรมธรรม์ที่ 1 - 10

ครบกำหนดสัญญา

รับเงินครบกำหนดสัญญา 422%

คุ้มค่า ลดหย่อนภาษีได้

เบี้ยประกันชีวิตสามารถนำไปอ้างอิง

ลดหย่อนภาษีเงินได้บุคคลธรรมดา

สูงสุด 100,000 บาท

Introduction of Insurance

Insurable Age

Benefit Plans

Mode of Premium Payment

Rider Attachment

Health Checkup

Tax Deduction

ไม่ว่าสายไหนก็ชอบความคุ้มค่า!

โอเชี่ยนไลฟ์ อีซี่ เซฟวิ่ง 11/4 รับความคุ้มค่าเกินคาด

ไม่ว่าสายไหน

ก็ชอบความคุ้มค่า!

โอเชี่ยนไลฟ์ อีซี่ เซฟวิ่ง 11/4

รับความคุ้มค่าเกินคาด

คุ้มจ่าย

จ่ายเบี้ยสั้น

คุ้มครองชีวิตยาว

คุ้มรับ

รับเงินคืนตั้งแต่ปีแรก

จนครบกำหนดสัญญา

คุ้มเวลา

สมัครออนไลน์

ง่ายทุกที่ ทุกเวลา

Coverage and Benefit

Conditions of Insurance

11 years / 4 years

- Non-contestation or Objection to the Incompleteness of the Insurance Contract

The company will not contest or object to the incompleteness of this insurance contract once the policy is in force, provided that the insured has been alive for a period of at least two years (2 years) from the effective date of coverage under the policy, or if the policy has been renewed, from the effective date of coverage under the renewal, or from the date the policy was reinstated to its previous status, or the date the company approves the increase in the sum insured. This is applicable only to the increased sum insured. However, this does not apply if the insured has no insurable interest in the event of insurance or if the age declaration is incorrect to the extent that the actual age exceeds the underwriting limits for the applicable premium rates.

If the company becomes aware of information that would allow the cancellation of the contract under the terms of Clause 1, but does not exercise the right to cancel the contract within one month (1 month) from the date it becomes aware of such information, the company may not cancel the completeness of the contract in this case. - Suicide or Homicide

The company will not pay the benefits under the policy in the following cases:

2.1 If the insured commits suicide voluntarily within one year (1 year) from the effective date of coverage under the policy, or if the policy is renewed, from the effective date of coverage under the renewal, or from the date the policy was reinstated to its previous status, or the date the company approves the increase in the sum insured, applicable only to the increased sum insured. In this case, the company's liability will only be limited to refunding the premiums paid for life insurance to the company, including premiums paid for policy renewal or reinstatement or for the increased sum insured, as the case may be.

2.2 If the insured is intentionally killed by the beneficiary, the company's liability will only be limited to refunding the policy surrender value to the heirs of the insured, under the following conditions:

2.2.1) If the policy has no surrender value, the company will, at its discretion, refund the premiums paid for life insurance to the heirs of the insured.

2.2.2) If there are multiple beneficiaries, and one beneficiary is not involved in intentionally killing the insured, the company will pay the sum insured to the beneficiary not involved in the death, excluding the share of the beneficiary who caused the death, and this portion will not be refunded.

In cases of refunding premiums or policy surrender value due to suicide or homicide, the company reserves the right to deduct any liabilities associated with the policy.

Q: Who is Ocean Life Easy Saving 11/4 suitable for?

A: This plan is suitable for individuals looking to build a disciplined savings plan, ensuring financial security for the future.

Q: Is a medical examination required for Ocean Life Easy Saving 11/4?

A: No health examination and health declaration in the insurance application form required.

Q: Can the premium for Ocean Life Easy Saving 11/4 be used for tax deductions?

A: Policyholders can claim a personal income tax deduction for life insurance premiums, up to a maximum of 100,000 THB, in accordance with the Revenue Department's regulations.

Q: Can additional riders be attached to Ocean Life Easy Saving 11/4?

A: Additional riders cannot be attached to this policy.

Q: What is the total benefit payout throughout the policy term for Ocean Life Easy Saving 11/4?

A: The total benefit payout throughout the policy term is 442% of the sum assured.

- % means the percentage of the sum assured.

- Underwriting is subject to the Company’s terms and conditions.

- Benefits and coverage are subject to the health insurance policy’s terms and conditions.

- Life insurance premiums are eligible for personal income tax deductions in accordance with the criteria set by the Revenue Department.

- Policyholders who wish to claim life insurance premiums for personal income tax deductions must declare their intent and provide consent for the company to submit their premium information to the Revenue Department.

- The information in this document serves as a preliminary overview of the insurance product. Prospective policyholders and insured individuals should review additional details and fully understand the coverage terms, benefits, and exclusions before making a purchase decision. Upon receiving the policy, please review it thoroughly.

เชื่อมั่นในประกันออมทรัพย์ หรือประกันสะสมทรัพย์

จากบริษัทที่ดูแลคนไทยด้วยความรัก มั่นคงยาวนาน 76 ปี

สินทรัพย์

106,769

ล้านบาท

เบี้ยประกันภัย

13,882

ล้านบาท

กำไรสุทธิ

2,109

ล้านบาท

อัตราส่วนเงินกองทุน

ต่อเงินกองทุน

ที่ต้องสำรองตามกฏหมาย

395%

จำนวนลูกค้าปัจจุบัน

1.3

ล้านคน

เชื่อมั่นในประกันออมทรัพย์

หรือประกันสะสมทรัพย์

จากบริษัทที่ดูแลคนไทย

ด้วยความรักมั่นคงยาวนาน 76 ปี

สินทรัพย์

106,769

ล้านบาท

เบี้ยประกันภัย

13,882

ล้านบาท

กำไรสุทธิ

2,109

ล้านบาท

อัตราส่วนเงินกองทุนต่อเงินกองทุน

ที่ต้องสำรองตามกฏหมาย

395%

จำนวนลูกค้าปัจจุบัน

1.3

ล้านคน

Interested in purchasing insurance product ?

Check premiums or compare with our other insurance